Pay-as-you-go: 5 considerations for evaluating whether earned-wage access can ease employee financial stress

A low-cost, high-return financial tool can help with retention and productivity.

Hand adding wooden cube with dollar sign

Research indicates that financial strain can trigger employee stress, depression, anxiety, and burnout. As organizations use financial-wellness initiatives to address these issues, one tool is on the rise for its small cost to employers and the big impact it can have on employees: Earned wage access.

Also known as on-demand pay, earned-wage access lets workers access their money before payday. PayPal, Walmart, and Dominos are some of the companies using this emerging-trend, benefit.

EWA is not a loan because employees have already earned the money. Funds aren’t distributed by the employer but by third-party vendors. In most cases, the employee pays the transfer fee, so employers see little to no cost. Service providers are mostly financial-technology companies and start-ups, and delivery can be direct to consumer or through employer contracts. Ultimately, earned-wage access can be a low-risk, high-return solution to the issue of employee financial stress.

What should an organization consider when looking at whether to offer on-demand pay as a financial wellness tool for employees?

First, organizations with a large number of hourly workers would benefit from a needs survey.

Seventy-four percent of Americans are living paycheck-to-paycheck, according to a 2019 American Payroll Association survey. Hourly employees are even more likely to find themselves needing money before payday—and the pandemic made the situation even worse. The general consensus is that organizations with sizeable hourly-worker populations will gain the most from offering on-demand pay. The benefit helps raise timesheet compliance to 100%, help workers budget and save better, and lower cash-till fraud rates.

Second, employees pay the fees unless employers choose to subsidize them

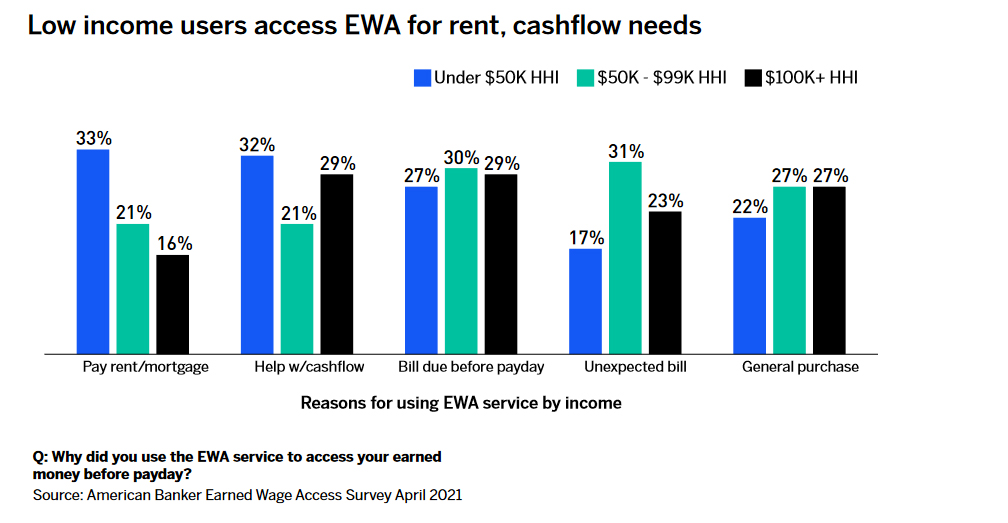

The standard fee structure in this industry is to charge more for same-day or instant access, which 77% of users choose. Typical providers use flat transaction-based fees. Users are typically low-income, withdrawing small amounts more often. The result is the low-income users pay more than higher-income users. While on-demand pay is undoubtedly less expensive and less financially harmful than payday loans, subsidizing the cost to employees is something to consider if an organization is genuinely looking to help its people get out of debt or stay out of it.

Third, there is an impact on equity for organizations looking to support their underserved populations.

A March survey of nearly 500 U.S. adults showed that 66% of Hispanic workers had used earned-wage access in the last three months, compared to 53% of White workers and 50% of Black workers. Hispanic workers had less access to credit cards, making EWA a popular benefit. Also, women benefited from EWA because they typically had less access to other financial tools like lines of credit.

The need for payday loans, the majority of which target minority populations, is undercut when employers offer EWA. This could positively impact the community around the organization.

Big returns on investment

The intent behind many organizations’ adoption of EWA is to positively impact their employees’ financial wellness, which in turn supports mental health and productivity.

“At the end of the day, companies are looking to offer benefits to employees that reduce financial stress and create a better relationship between employer and employee,” says DailyPay’s chief innovation and marketing officer, Jeanniey Walden. DailyPay is an EWA provider whose clients include Kroger grocery stores, Captain D’s restaurants, and BrightSpring health services.

Walden says EWA programs increase employee tenure by 72%, contingent on industry. Replacing an employee can cost one- to two-times their annual salary. Companies that have invested in EWA have seen an average 45% reduction in turnover, saving them millions. Walden says one DailyPay client, BrightSpring, a home-based health care provider in Louisville, saved $10 million a month with increased employee retention.

Employers have also noticed that employees have more transparency regarding their paycheck when using on-demand pay. Employers see more workers showing up to work on time and picking up an extra shift when they see they’ll need it. Companies observed an increase in productivity by three to four times the rate before EWA was offered.

Ultimate Care gets competitive

Ultimate Care, a home-based care agency in Brooklyn, New York, employs 2,000 workers. “Field employees in the homecare industry have a tough job,” says Carol Shafir, director of patient services at Ultimate Care. “They are extremely hard-working, loyal and dedicated. However, with the cost of living rising, most are lower-income and live paycheck to paycheck.”

Over time, the company heard stories of employees struggling financially, unable to afford lunch or even a subway ride home. Ultimate Care decided to try EWA as a benefit, knowing it would bring relief to many of their staff members, Shafir says.

Michael Wallach, chief operating officer, says employees are highly engaged with the benefit, using it to pay bills or other critical time-sensitive expenses.

“For Ultimate Care, it is an opportunity to stand out from the many other licensed home-care agencies operating in the New York metro space and show that we care about our employees,” Wallach says.

One complication the organization experienced with EWA was employee confusion on where their pay was deposited after signing up for the service. Service providers operate differently, with some offering to use an employee’s current bank account and others offering bank accounts or a debit card. Wallach said Ultimate Care’s provider was able to fix the issue quickly, and it’s otherwise been a smooth transition.

Ultimate Care has been impressed enough with its ROI to upgrade the benefit for its employees. “With the current success of the program and the positive response from participants, we are now choosing to make a great program even better by implementing a program to subsidize the benefit, allowing our staff to really maximize the perks of the DailyPay benefit,” Wallach says.

EWA as a flexible tool

DailyPay’s Walden says she’s seen employees use EWA to pay for education credits, improve credit score before a big purchase, or even invest in children’s college funds. DailyPay has also seen employers use EWA to pay out bonuses, incentivize workers, and hand out cash amid major crises like natural disasters. “We believe that our employees are family,” says Ultimate Care’s Shafi. “We pride ourselves in really getting to know who they are, what’s really important to them and how we can help them by offering benefits that are useful in their day-to-day lives.”

COMMENT

Ragan.com Daily Headlines

RECOMMENDED READING

Tags: earned wage access, financial wellness, on-demand pay, turnover