Boardroom diversity’s a bottom-line benefit

Turns out it’s not just the right thing to do. New data suggests that making your board more inclusive can help boost revenue.

A recent headline in “The Onion” offers a painfully accurate summation of corporate America’s approach toward leadership diversity: “Company struggling to find diverse leadership candidates among CEO’s golf buddies.”

While this goof certainly elicits a well-earned chuckle, C-suite uniformity is no laughing matter. The same goes for boardroom diversity, which new research from BoardReady indicates is tied to higher revenue.

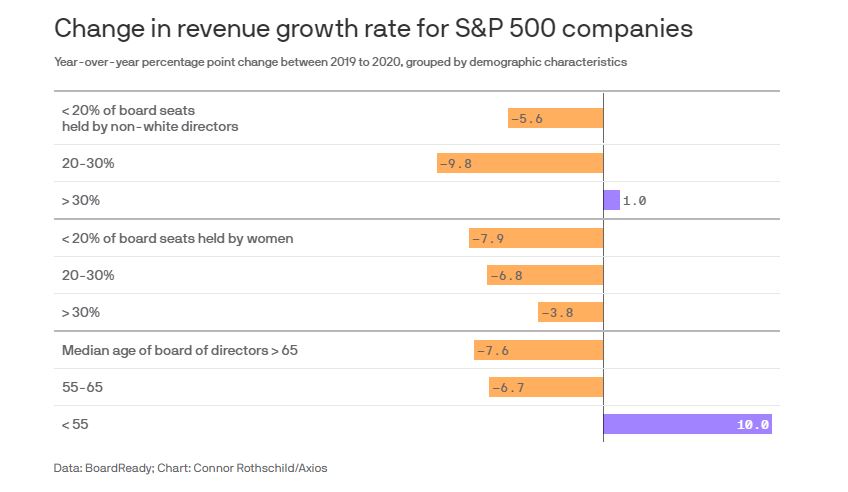

Citing data from BoardReady, Axios reports that companies with more diverse boards performed better (in terms of revenue) than less diverse competitors during the pandemic.

The research also reveals:

- The companies with more women on their boards saw the smallest year-over-year drop in revenue growth in 2020.

- And a group of companies with board members whose ages spanned over 30 years saw an improvement in revenue growth compared to the prior year. The rest saw growth slow.

- The businesses with at least 30% of seats filled by non-white executives saw a bigger jump in revenue growth. However, those that had between 20% and 30% non-white board executives fared worse than those with fewer non-white members.

There are caveats, here. Axios writes that the study doesn’t necessarily prove the notion that diverse boards lead directly to higher revenue. For starters, corporate boardrooms are still so thoroughly dominated by older white men that it’s difficult to compile a compelling amount of data. As BoardReady puts it, “so few companies have enough non-white executives on their boards to meet that threshold.” However, the data “adds to a ballooning body of research that shows that generally better business comes alongside boardrooms that are less old, male and white.”

Despite such daunting uniformity at the top levels of corporate America, numbers are slowly improving. Citing a study by Spencer Stuart, Axios also notes that women made up 28% of all S&P 500 corporate board members last year, which is up from 16% in 2010.

For those still unconvinced by the merits of seeking greater boardroom diversity, there are legal implications to consider. The state of California, Securitieds and Exchange Commission regulators, and Nasdaq are all pushing for greater transparency on corporate governance. You can bet your bottom dollar that your employees—and your customers—are paying closer attention, too.

There are multitudes of reasons why pursuing and prioritizing boardroom diversity makes good business sense. Perhaps the most compelling is that it might also make good business cents.

For more data on the benefits of diverse boards, read the full report here.